Annual billing FAQs

How do I know my payment method? / Am I paying by Direct Debit?

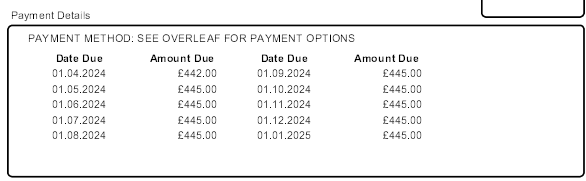

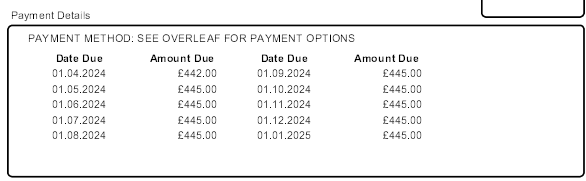

Your payment details are shown on the front of the bill, and will look similar to one of the images below.

Direct debit:

Non-direct debit:

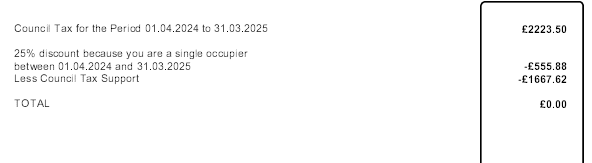

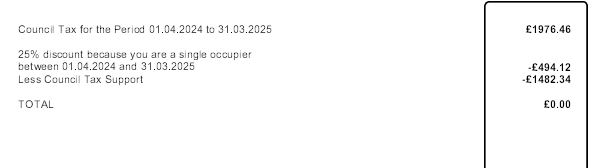

What discounts and exemptions do I have?

This is shown on the front page of your bill and will look similar to the image below.

Does my direct debit carry over to the new year?

Yes, if you paid by direct debit last year then this will be set up automatically for the new year too.

Will my standing order carry over to the new year?

No, you will need to set up a new standing order. Details of how to do this are on the back of your bill.

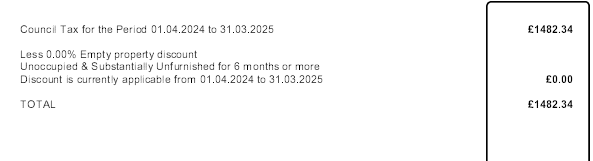

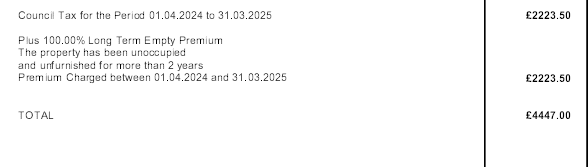

Why am I being charged for my empty property?

There is no discount for empty properties, so you will still have a liability to pay and will receive a bill. If the property has been empty for more than two years then an empty property premium may be applied as well.

If an empty home premium has been applied it will look like this:

Why isn’t my change of circumstances showing on my bill?

All information was sent to the printers on the 24 February, so any changes that were not processed before then will not appear on your annual bill. As soon as the change is processed you will get a new bill.

Am I still getting my Council Tax Support payment?

You will see this on the front of your bill in the same location as the discounts and exemptions.

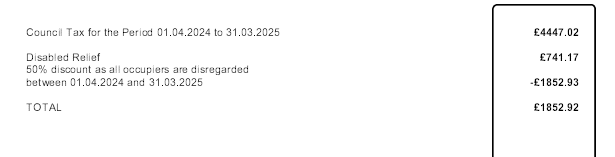

Is my disabled band reduction still in place?

Yes, this will show on the front of your bill and will look similar to the image below.

Last updated: Friday, 1 March 2024 10:18 am